URGENT: Roth Benefits Under Congressional Review

The Government Partnership You Never Agreed To Could Get Much More Expensive... Unless You Act Before Congress Eliminates These Benefits

If you're between 45-70 with money in a 401(k) or IRA, the next 13 minutes could save you $300,000+ in retirement taxes (even if you have no financial background or current advisor)

(Video reveals how to legally break free from the tax-deferred trap before potential rule changes)

Because I Deserve To Get My Retirement Money In Full!

The Tax-Free Retirement Blueprint

Convert Your 401(k) & IRA Into Tax-Free Income Before Potential Roth Benefit Elimination

Average Client Saves $500,000+ In Lifetime Taxes

No Required Minimum Distributions

Possible Tax-Free Social Security

Lower Medicare Premiums

Tax-Free Legacy For Your Kids

Special Price: $399 (Regular $2,997)

Because My Kids Deserve My Legacy!

Your 401(k) Is A Tax Time Bomb

You've done everything "right" for decades:

Contributed to your 401(k) religiously

Followed conventional wisdom

Sacrificed and saved every penny

But now you're facing a terrifying reality:

Your retirement account isn't really yours. It's a partnership with the IRS where they control:

The tax rates you might pay (rates could increase with deficit pressures)

When you must withdraw (RMDs at 73)

How much of your Social Security gets taxed

With the national deficit at record highs and Congress actively seeking new revenue sources, this partnership could become much more expensive.

Because I have worked too hard to let my money drain!

Your 401(k) Is A Tax Time Bomb

You've done everything "right" for decades:

Contributed to your 401(k) religiously

Followed conventional wisdom

Sacrificed and saved every penny

But now you're facing a terrifying reality:

Your retirement account isn't really yours. It's a partnership with the IRS where they control:

The tax rates you might pay (rates could increase with deficit pressures)

When you must withdraw (RMDs at 73)

How much of your Social Security gets taxed

With the national deficit at record highs and Congress actively seeking new revenue sources, this partnership could become much more expensive.

Because I have worked too hard to let my money drain!

Meet Your Guide:

Injil, Your CPA Instructor,

With 25 Years Successfully Negotiating With the IRS From Madison Avenue”

Injil Muhammad

Saved clients over $100 million in tax settlements

Negotiated $15 million settlement for single

business owner

Featured on nationally syndicated radio shows

Author of "Overtaxed"

Average client saves $500,000+ in lifetime taxes

"I'm 61 and a proud grandfather. I understand what it means to protect what you've built - not just for yourself, but for the people you love."

Meet Your Guide:

Injil, Your CPA Instructor,

With 25 Years Successfully Negotiating With the IRS From Madison Avenue”

Injil Muhammad

Saved clients over $100 million in tax settlements

Negotiated $15 million settlement for single business owner

Featured on nationally syndicated radio shows

Author of "Overtaxed"

Average client saves $500,000+ in lifetime taxes

"I'm 61 and a proud grandfather. I understand what it means to protect what you've built - not just for yourself, but for the people you love."

The Million-Dollar Secret

There's a legal, IRS-approved way to fire the government as your retirement partner.

It's called a Roth conversion - and it's the single most powerful wealth-building tool for middle-class Americans.

Here's how it works:

1

Move money from tax-deferred accounts (401k/IRA) to tax-free accounts (Roth).

2

Pay taxes once at current rates.

3

That money is yours forever - government can never touch it again (qualified withdrawals never taxed).

Real Results:

Saved $350,000 in lifetime taxes

- Susan, Nurse, 62

Used business losses to offset the tax associated with her Roth conversion

- Linda, Teacher, 55

Social Security now completely tax-free

- Mark & Janet, 67

Because I'm Done Giving In All My Life!

Why Your Current Strategy Could Be Failing

The concerning truth about 401(k) contributions:

When you contributed, you got a tax deduction. But uncertainty looms over future tax policy with record deficit spending.

Plus your advisor told you: "You'll be in a lower

bracket in retirement."

But they may have overlooked:

Qualified investment growth in Roth accounts is tax-exempt

Required Minimum Distributions (RMDs) force

withdrawals at 73

RMDs can push you into higher tax brackets

Up to 85% of Social Security can become taxable

Medicare premiums can increase by hundreds per month

Because I Can't Risk My Legacy!

The Nightmare Scenarios

(Happening Right Now)

Over her lifetime, she was on track to pay over $400,000 in unnecessary taxes — on money she had already earned and saved by living below her means

- Susan

$800K in IRA accounts → RMDs increased Medicare from $165 to $395 each per month → Extra $5,520/year forever

- Mark & Janet

This is happening to thousands of retirees who thought they did everything right.

Because I've Been Burnt A Lot All This While!

The 3-Bucket Strategy That Changes Everything

Bucket 1: Taxable - Pay taxes on growth every year

Bucket 2: Tax-Deferred (401k/IRA) - Pay taxes on everything you withdraw

Bucket 3: Tax-Free (Roth) - Qualified withdrawals

never taxed

Most people have 90% of their retirement assets in Bucket 2 — potentially the worst place for retirement income now, and even more detrimental if tax policy changes.

We move your money to Bucket 3 where the government can never touch it again (remember, qualified withdrawals are

never taxed).

The key: Do this during optimal timing before potential rule changes. Act now while current Roth benefits remain in place.

Because I Need My Money In Bucket 3 Where They Can't Touch It!

Proven Client Results

"Hi, my name is Bill and I'm from Connecticut and I have been involved in some IRS problems and difficulties with past years do, and I have, by the grace of God found Injil Muhammad and his staff and have been able to work out solutions in a favorable situation and as well as continue to do my business and work and get answers to the several problems which I was really frankly lost in."

- Bill

"I couldn't have done it without you. Without you, I would be not in good shape. I always have a chance of surviving. You took me from the bottom of the worst to be able to live every day my life thanks to you. So you saved my life."

- Barry E.

"Muhammad was able to negotiate with the IRS, the amount went to $16,000. Repeat again, it's unbelievable from $1,600,000 to $16,000.

If it wouldn't be for them, I would be, I really don't know where and right now I'm not afraid of starting my own business again thanks to Muhammad and the staff."

- Manual V.

"He's been doing a fine job for me. He's been very responsive, and so is the staff. Unlike a lot of the people that are out there, they advertise that they can do something.

But what they're doing is giving you a line of baloney when in reality when he says he's going to do something he does it, but he's been doing a fine job for me and he's going to be continuing as my agent."

- Vincent L.

"Over the last 20 years, my income has come from many sources, including several partnerships, and he's always been extremely adept at understanding the tax code, my personal situation, and thinking about how best to protect me and my family from undue tax burdens.

He has been an absolute pleasure to work with, and he has a very solid team that's really quick to get back to you, extremely courteous."

- Jose C.

"My name is Sally Gutierrez and I just attended the retirement planning course. What I got out of it was, a really great comprehensive overview of the process, it was kind of a very gray area for me.

There were a lot of really great tips on, you know, investment types and, and things to consider when you are investing, what type of accounts that you wanna invest your money in and the tax benefits, across the different types."

- Sally G.

Because I Know, With The Right Guidance, I Can Secure My Reitrement!

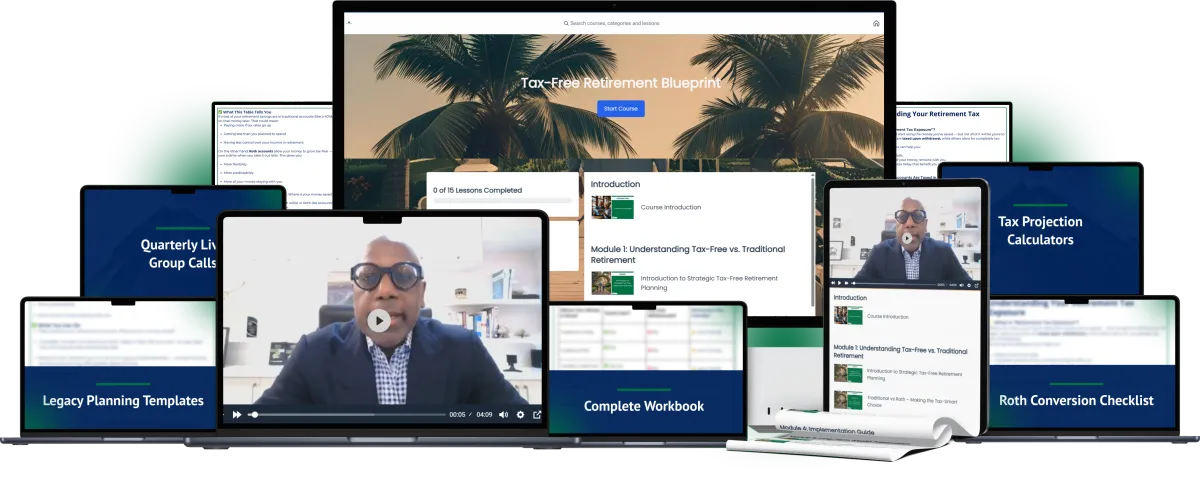

Introducing:

Tax-Free Retirement Blueprint

The same system my $1M+ clients pay thousands for - now available to everyone.

What You Get:

MODULE 1: Understanding Your Tax Burden

✓ Analyze your retirement accounts using my proven framework

✓ Calculate your potential lifetime tax liability

✓ Identify optimal conversion opportunities

MODULE 2: The Roth Conversion Strategy

✓ Determine optimal timing and amounts

✓ Leverage current deduction opportunities

✓ Avoid costly mistakes that trigger penalties

MODULE 3: Tax-Efficient Implementation

✓ Execute conversions without touching retirement money

✓ Maximize available deduction benefits

✓ Pay minimum taxes legally

MODULE 4: Withdrawal Strategies

✓ Take money out tax-free in retirement

✓ Keep Social Security untaxed

✓ Minimize Medicare premiums

MODULE 5: Legacy Protection

✓ Pass wealth to children tax-free

✓ Protect against future tax law changes

✓ Build generational wealth

Because This Will Pay For Itself!

Plus Get Exclusive Bonuses (Worth $2,000+)

The Tax-Free Retirement Blueprint

Implement the strategy to immediately convert your 401(k) & IRA money into Tax-Free Income, potentially saving 10s of thousands of dollars in taxes.

Here’s everything you get when you join now:

The Complete Tax-Free Retirement Blueprint: With 5 focused modules to get you tax-free (Value: $999)

- Module 1: Understanding Your Tax Burden

- Module 2: The Roth Conversion Strategy

- Module 3: Tax-Efficient Implementation

- Module 4: The Ultimate Withdrawal Strategies

- Module 5: Wealth Legacy ProtectionQuarterly Live Group Calls - Get your specific questions answered (Value: $1,999)

Private Community Access - Connect with others on the same journey (Value: $299)

Complete Retirement Blueprint Workbook - Reference forever (Value: $199)

Roth Conversion Checklist - Step-by-step implementation (Value: $99)

Tax Projection Calculators - See potential savings (Value: Priceless)

Legacy Planning Templates - Protect your family's future (Value: Priceless)

Total Value: $3,595

When launched for the public: $999

Your Investment In Your Tax-Free Retirement Today:

Just $399

Common Objections Answered

"I should talk to my financial advisor first."

Ask them: "What's my projected lifetime tax bill and how would Roth conversions change that? “What steps can I take now in the event that Congress eliminates

Roth benefits?”

If they can't give specific numbers and address policy uncertainty,

you need better guidance.

"I'm too close to retirement."

If you're 60, you have 30+ years of retirement ahead. Longer than most careers. Not too late to potentially save hundreds of thousands.

"I don't want to pay taxes now."

You have to pay taxes eventually anyway. Pay at current rates while you have control, or risk higher rates or eliminated benefits with no control.

Would you rather pay taxes on the seed or the harvest?

Because I'm Done Letting Anyone Else Take Advantage Of My Efforts!

This Window Could Be Closing

With record national debt, Congress is actively discussing revenue-generating measures including potential elimination of Roth benefits.

Historical precedent: People who act before rule changes often get grandfathered in.

Convert now = Potentially protected forever

Wait for rule changes = Risk losing opportunity

Every month you wait = Potential opportunity lost

Every year you delay = Risk of policy changes

Try It Risk-Free –

100% Money-Back Guarantee

If you don’t feel a significant reduction in your anxiety after completing the course, I’ll give you a full refund, no questions asked. You have 30 days to see results, or your money back.

Your Choice Is Simple

Path 1: Keep doing what you're doing

Hope tax policy remains favorable (uncertain)

Hope RMDs don't impact your retirement (they will)

Risk government policy changes affecting your savings

Path 2: Take control right now

Act while current Roth benefits exist

Secure tax-free income potential for life

Protect your family's financial future

The Tax-Free Retirement Blueprint

Just $399

Your retirement doesn't have to be at the mercy of uncertain government tax policy.

Take control while you still can. Your future self will thank you.

Is This For You?

This IS For You If...

You're ready to build a real brand, not just another generic fashion label

You want to create something meaningful that customers actually connect with

You're willing to put in the work during the first 6 weeks to set up your foundation

You believe in providing genuine value and building emotional connections

You're coachable and ready to follow a proven system

You want to leverage brand meaning instead of competing on price

You're excited about building a brand with lasting cultural impact

You have creative vision but need clear direction

You're tired of watching others succeed while sitting on the sidelines

You understand that success requires implementation, not just information

This is NOT For You If...

You're looking for a "get rich quick" scheme with zero effort

You want to build a cheap product line with no brand meaning

You're not willing to invest time in the first 6 weeks to set up properly

You prefer to "figure it out yourself" rather than follow proven systems

You're looking for overnight success without putting in the work

You're not interested in building a real, sustainable brand

You're not willing to learn and adapt as the market changes

You want to cut corners and compromise on quality

You're not ready to take action and implement what you learn

Frequently Asked Questions

How long do I have access to the course materials?

Lifetime access to all course materials, updates, and resources.

What if I don't have a financial background?

The course is designed for everyday Americans. No financial expertise required.

Can I get personalized advice for my situation?

The course provides frameworks and tools. For personalized guidance, consider scheduling a Tax Plan or Roth Conversion Analysis consultation.

What's included in the 30-day guarantee?

If you're not satisfied within 30 days of purchase, contact our support team for a full refund. No questions asked.

How soon can I start implementing these strategies?

Immediately after purchase. Course is delivered instantly with step-by-step implementation guides.

*Refund Policy: 30-day money-back guarantee. Finish the program, implement the action items, and if you can't see any benefits from what you learned, you can get a refund. Refunds processed within 5-7 business days of approved request.

© 2025 Tax-Free Retirement Blueprint. All Rights Reserved.

For questions and concerns, please email [email protected]